Welcome to the Digital Frontier

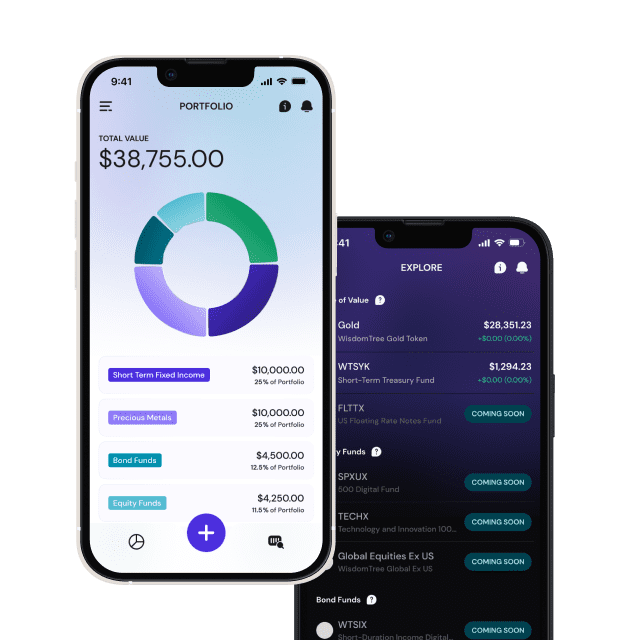

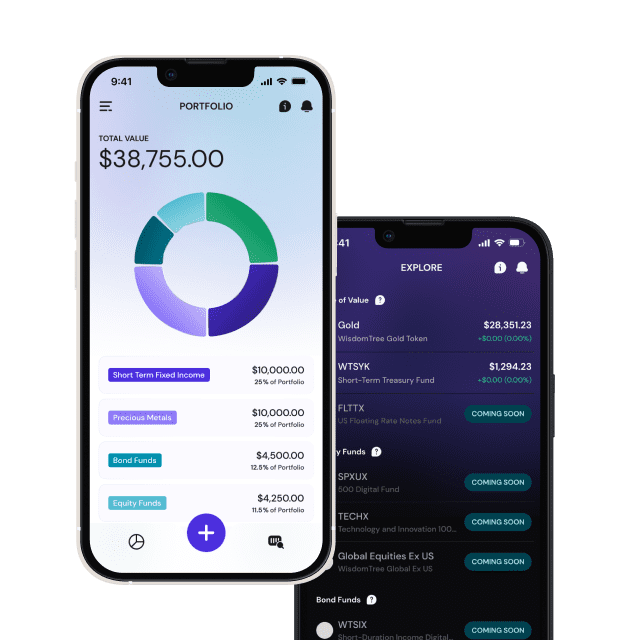

WisdomTree Digital Funds are a big step forward in the next evolution of investing, and the exciting future of finance.

You can read more about the funds here. To purchase the funds, download the WisdomTree Prime app today!

WisdomTree Prime Digital Funds

Funds are exclusive to the WisdomTree Prime® mobile app.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: to obtain a prospectus or summary prospectus containing this and other important information, please call 866.909.WISE (9473), or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal.

You could lose money by investing in the Money Market Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not a bank account and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s adviser is not required to reimburse the Fund for losses, and you should not expect that the adviser will provide financial support to the Fund at any time, including during periods of market stress.

You cannot invest directly in an index.

There are risks associated with investing, including possible loss of principal. Because the Funds are new, they have no performance history. Blockchain technology is a relatively new and untested technology, with little regulation. Potential risks include vulnerability to fraud, theft, or inaccessibility, and future regulatory developments effect its viability. Funds focusing investments on certain sectors increases its vulnerability to any single economic or regulatory development, which may result in greater share price volatility. U.S. Treasury obligations may provide relatively lower returns than those of other securities. Changes to the financial condition or credit rating of the U.S. government may cause the value to decline. TIPS can provide a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value and negatively impact a Fund’s NAV, particularly if changes in prevailing interest rates are more frequent or sudden than the rate changes for floating rates notes, which can only occur periodically. Fixed income securities are subject to interest rate, credit, inflation, and reinvestment risks. Generally, as interest rates rise, the value of fixed-income securities falls. Cybersecurity attacks affecting a Fund’s third-party service providers, App, blockchain network, or the issuers of securities in which the Fund invests may subject the Fund to many of the same risks associated with direct cybersecurity breaches.

WisdomTree Funds are distributed by Foreside Fund Services, LLC.