Key Takeaways

- The bitcoin halving is coming in April

- Historically, the halving has been a strong performance catalyst

- Current supply of bitcoin is tight amidst strong ETF demand for bitcoins

- The rate of bitcoin issuance will be cut in half, further tightening supply

One of the biggest events in crypto this year is the much anticipated ‘bitcoin halving’, which is expected to take place in just a few short weeks. Historically, this stage of bitcoin’s market cycle has led to extremely positive price action for investors. We know history can’t predict the future, but if we note a few unique developments this ‘halving’ season, there may be some optimistic signs of what the path ahead may look like.

The halving

In April of 2024, an event referred to as ‘the halving’ will occur within the bitcoin protocol. This would be the fourth in Bitcoin’s history. It is written into the code that the block reward1 paid to bitcoin miners will shift from 6.25 bitcoin to roughly 3.13 bitcoin once the blockchain reaches 840,000 blocks. As a result, Bitcoin’s protocol has a so-called ‘halving cycle’ every 210,000 blocks, which equates to approximately every four years. We have seen these events before – rewards started at 50, dropping to 25, then 12.5 and then 6.25. The process repeats until approximately 2040, at which point the block reward will approach zero, and the full 21 million bitcoin that will ever be issued will be in circulation. Currently, approximately 19.7 million of this 21 million maximum is in circulation.

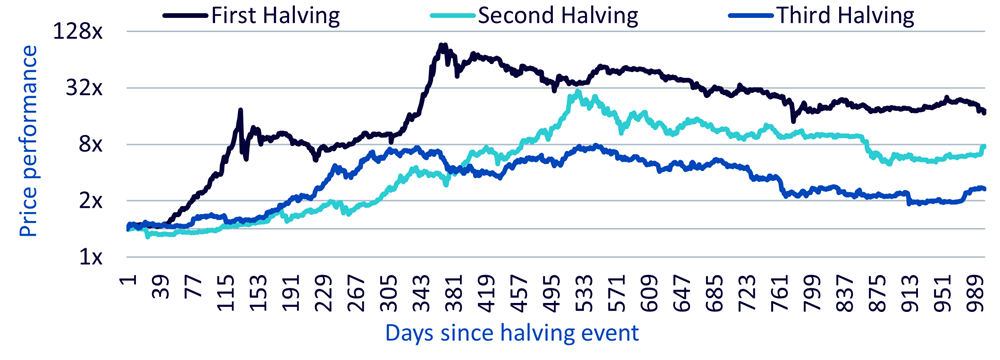

Figure 1 is a chart that we have shown before, noting that if we scale bitcoin’s price on the day of the halving to 1.0, we see that over the subsequent period of roughly 2.5 years, there was further price appreciation in each of the three cases. In each instance of historical halvings, representing a period in the bitcoin cycle, we’ve observed prices reaching higher highs and higher lows.

Here, we can think about bitcoin on a supply/demand basis. If demand is outpacing supply, there should be upward pressure on the price. The halving indicates that there is less new bitcoin supply coming into the world, so if demand merely remains the same then the supply/demand balance immediately shifts more toward demand outpacing supply.

Figure 1: Bitcoin’s price behaviour after the three previous halving cycles

Source: Glassode, WisdomTree as of December 2023. Rebased to 1 in from halving date. Historical performance is not an indication of future performance and any investment may go down in value.

Bitcoin is highly speculative and involves a high degree of risk, including the potential for loss of the entire investment. An investment in bitcoin involves significant risks (including the potential for quick, large losses) and may not be suitable for all investors.

Spot bitcoin ETFs: A new source of demand

One of the most-loved attributes of bitcoin regards the certainty of supply based on the protocol’s code over the course of time. We know that in 2040, there will be 21 million bitcoin2 and we know that nothing can occur to change this. We know, as stated with the halving, the minting of new supplies coming online is being reduced by half roughly every four years.

This is in direct contrast to fiat currency systems where governments can decide to print more units of currency on an unlimited basis. Throughout history, we’ve seen examples of fiat currencies losing their value and primacy due to further printing. We have seen the US dollar lose value over time after breaking the link to gold in 1971, allowing the US Government to print more currency without needing it to be backed by units of gold.

It was hypothesised that if the Securities and Exchange Commission in the US approved spot bitcoin ETFs new sources of demand to hold bitcoin would open up. Similar to how, in 2004, a new option opened up for investors who did not want to go through the hassle of acquiring and storing physical gold bars, in 2024, investors were allowed to gain exposure to spot bitcoin through the familiar brokerage platforms that they trade ETFs backed by other types of assets.

Now, a little more than two months into the journey, we can review how the supply/demand story has been evolving in bitcoin and whether we can clearly see any influence from the ETFs.

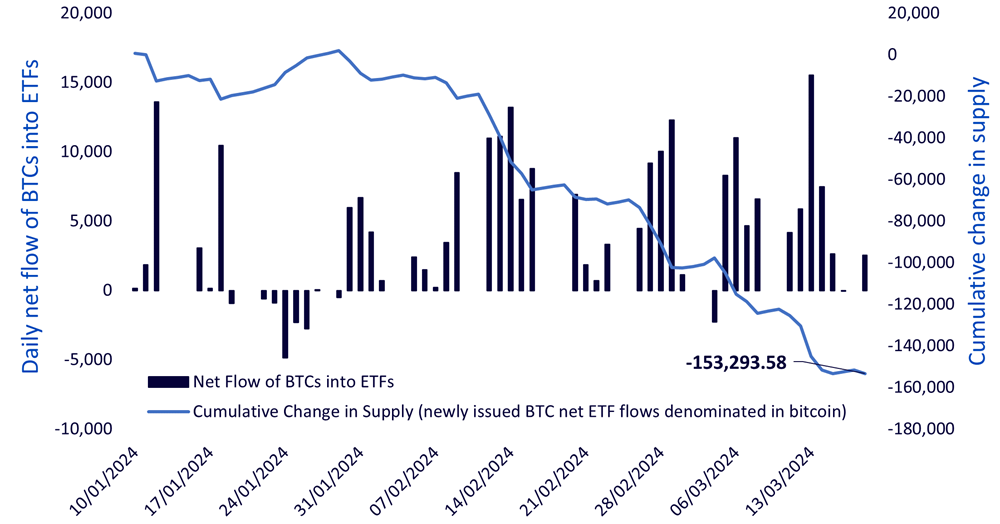

In the figure below, we can see:

- There has been more buying than selling: One hypothesis advanced before the ETFs launched regarded more investor types – those precluded from setting up their own crypto wallets for example – could access the exposure. The daily net flow of BTCs into ETFs is absolutely skewed to the positive end of the spectrum. We’d note that there were still many investors working at firms where internal oversight has not yet issued blanket approvals to use these products across the board.

- ETF buying has outpaced bitcoin issuance: ETF buying of bitcoin has outpaced the creation of new bitcoin over this specific period by roughly 130,000 units. The space is transparent – we can see the ETF buying, the wallets, and how long it has been since individual units have moved.

Figure 2: ETF demand vs bitcoin issuance

Source: Dune Analytics, Glassnode as of March 25, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

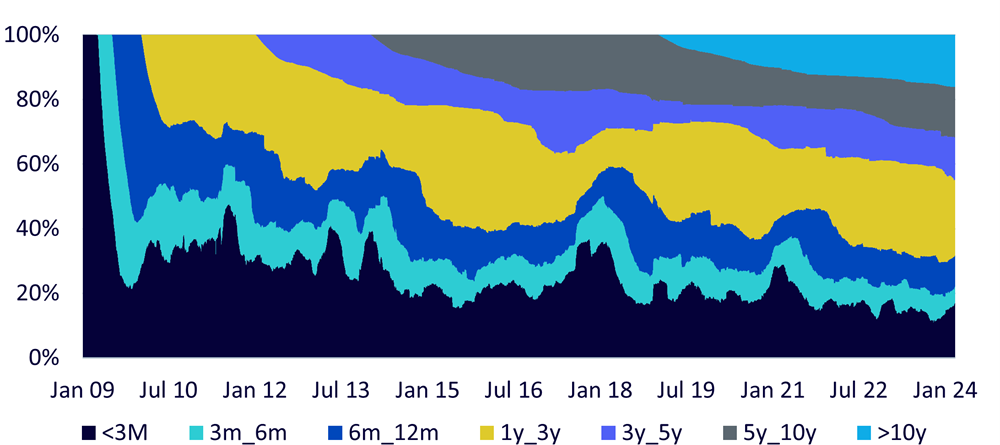

This may not always be the case and we’d note that the overall value of the bitcoin market is over $1 trillion right now3, but there are large volumes of bitcoin that are proven to not trade with a high frequency. By analysing transactions on the blockchain it can be shown that only about 30% of bitcoins have actually moved wallets in the last year – the active supply. Consequently, this means nearly 70% of supply has been dormant during this period. If this is any indication that bitcoin’s investment case as a long-term store of value or ‘digital gold’ is beginning to take hold, this may be a sign that this dormant bitcoin supply is ‘not for sale’.

Figure 3: Bitcoin active supply

Source: Glassnode as of March 11, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

Will the halving once again be a catalyst for positive performance?

While investors continue to search and refine better ways to develop price targets, we find it more informative to consider supply and demand. If bitcoin truly is ‘digital gold’, taking such an approach makes sense. Right now, it appears that ETF demand is high and wallets are holding onto their bitcoin for longer. However, we also know that the halving is coming which will reduce new issuance. Each of these points leads to a tighter supply and potentially increased demand via the ease of access introduced with the launch of bitcoin ETFs. If the wave of global adoption continues, all signs point to another halving cycle with strong performance.

Sources

1 Block reward is a payment received by miners for validating transactions and adding blocks to the blockchain.

2 Bitcoin’s supply policy places a ‘hard cap’ of 21 million on the maximum number of Bitcoin that can ever be created. This can be found in Bitcoins code base here: https://github.com/bitcoin/bitcoin/blob/v25.0/src/consensus/amount.h (github.com, 2024).

3 CoinMarketCap, 2024