The Federal Reserve (Fed) paused rate hikes in September, after having hiked in July (no policy meetings occur in August). However, the Federal Open Market Committee (FOMC) has adjusted its rate expectations for the upcoming year. Ten FOMC participants expect the Fed Fund target mid-point to be above 5% by the end of 2024. That compares with only six at the June meeting. the majority expected rates between 4.25-4.50% for end 2024, which is now the lowest anticipated range, with only two members aligning with it. This suggests the Fed is adopting a ‘higher for longer’ narrative.

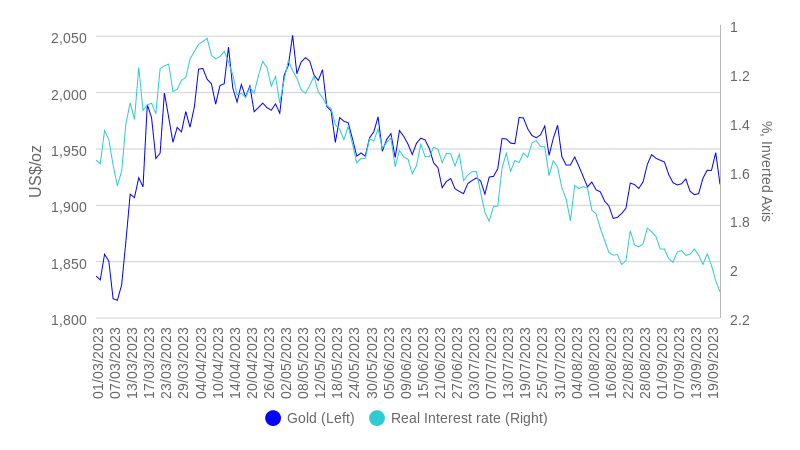

While Fed Fund futures are pricing at the end of the hiking cycle, markets are recalibrating for a higher for longer scenario, and as a result, 10-year Treasury yields are spiking. At 4.47%, 10-year Treasury nominal yields are at their highest since 2007. Real yields at 2.11% are also the highest since 2008. That would normally place immense pressure on gold. Gold, however, is holding its own, with the yellow metal continuing to defy the historic real yield-gold relationships.

Figure 1: Gold vs real rates (Treasury Inflation-Protected Securities yield)

https://embed.chartblocks.com/1.0/?c=6512ae2e3ba0f6956811590b&t=0a15b3c7fc4940f

Source: Bloomberg, WisdomTree. 01/03/2023 – 22/09/2023. Historical performance is not an indication of future performance and any investments may go down in value.

Gold (in US Dollars) is also being flanked by an appreciating US Dollar. The US Dollar basket has appreciated by 5.8% between 13 July 2023 and 22 September 2023. Markets are also recalibrating where they think other central banks will end up. The Bank of England unexpectedly held rates in September and the European Central Bank’s September rate hike could be its last. A few months ago, markets were expecting these other central banks to continue to raise for longer. The interest rate differentials now support a stronger US Dollar, which is a headwind for gold. Once again gold appears to be dealing with this headwind very well.

Gold in other currencies is exhibiting considerably more strength. Gold in Yen is at an all-time high. Gold in Euros is only 2.9% below its all-time high reached in on 17 March 2023.

Figure 2: Gold and Dollar Basket

https://embed.chartblocks.com/1.0/?c=6512b6863ba0f6936c11590b&t=df28cb15de7a92e

Source: Bloomberg, WisdomTree. 02/01/2023 – 22/09/2023. Historical performance is not an indication of future performance and any investments may go down in value.

Gold continued to see outflows from Exchange Traded Products (ETPs). That seems to reflect apathy towards physical gold from many institutional investors. In an environment of higher interest rates, some institutional investors are opting for gold futures exposure (due to the positive collateral yield embedded in futures prices). This trend explains why speculative positioning in gold futures remains around the long-term average.

Figure 3: Gold held in exchange-traded products

https://embed.chartblocks.com/1.0/?c=6512b94f3ba0f66e6d11590b&t=97d944a58873bec

Source: Bloomberg, WisdomTree. 01/01/2015 – 22/08/2023. Historical performance is not an indication of future performance and any investments may go down in value.

Figure 4: Net speculative positioning in gold futures

https://embed.chartblocks.com/1.0/?c=6512d0503ba0f6427911590b&t=ffc61e6cc4acefe

Source: Bloomberg, WisdomTree. 01/04/2015 – 22/08/2023. Historical performance is not an indication of future performance and any investments may go down in value.

Retail gold demand, however, remains strong. Especially in China, where the price premium over the institutional London market has risen to an all-time high. As the Chinese government stimulates the economy, we could see continued strength in Chinese demand. Given the large arbitrage, we are likely to see gold flow from London to China. According to the World Gold Council, Chinese gold ETPs saw inflows for three consecutive months – June, July and August – marking a clear divergence from international trends. In August 2023, Chinese ETP purchases were the highest since July 2022 amidst poor local equity performance and currency weakness.

Figure 5: Shanghai Gold Premium

https://embed.chartblocks.com/1.0/?c=6512eec33ba0f6030a11590b&t=4a84c980b5ee353

Source: WisdomTree, Bloomberg. February 2010 – September 2023. 30-day moving average. Historical performance is not an indication of future performance and any investments may go down in value.

In addition, the People’s Bank of China announced a purchase of 29 tonnes of gold in August, marking 10 consecutive months of gold buying. While many other central banks have not reported their August purchases yet, July data shows continued net buying. As we commented in earlier editions of this report, April and May data were aberrations due to Turkey’s central bank selling gold to meet local gold liquidity needs when gold imports were temporarily halted. Since those halts have been removed, Turkey’s central bank has resumed gold purchases, with 11 tonnes in June and a further 17 tonnes in July.

Figure 6: Central bank gold purchases

https://embed.chartblocks.com/1.0/?c=6512e3b23ba0f6770411590b&t=cac59de7e442eab

Source: International Monetary Fund, World Gold Council. January 2022 – July 2023. Historical performance is not an indication of future performance and any investments may go down in value.

Important Disclosure:

Past performance is not a reliable indicator of future performance. The price of gold does fluctuate and may be affected by numerous factors including supply and demand, the global financial markets and other political, financial, or economic events, which may negatively impact gold prices.