Key Takeaways

- Bitcoin halving will reduce bitcoin block subsidy from 6.25 to 3.125

- In the past, Bitcoin halving events have lead to strong performance, can this happen again?

The Bitcoin ‘halving’ ( or ‘halvening’ as some say) is an event that takes place in the Bitcoin network roughly every four years, where the newly issued (or mined) bitcoin is cut in half, reducing oncoming supply. At a point near the year 2140, the total supply of 21 million bitcoin will be mined, and no more new supply will become available to the market. Economics 101 would say that holding demand constant, this tightening of supply, would lead to higher prices – which is what has been observed in past events such as this. Will this be the case once again?

Concepts underpinning the halving

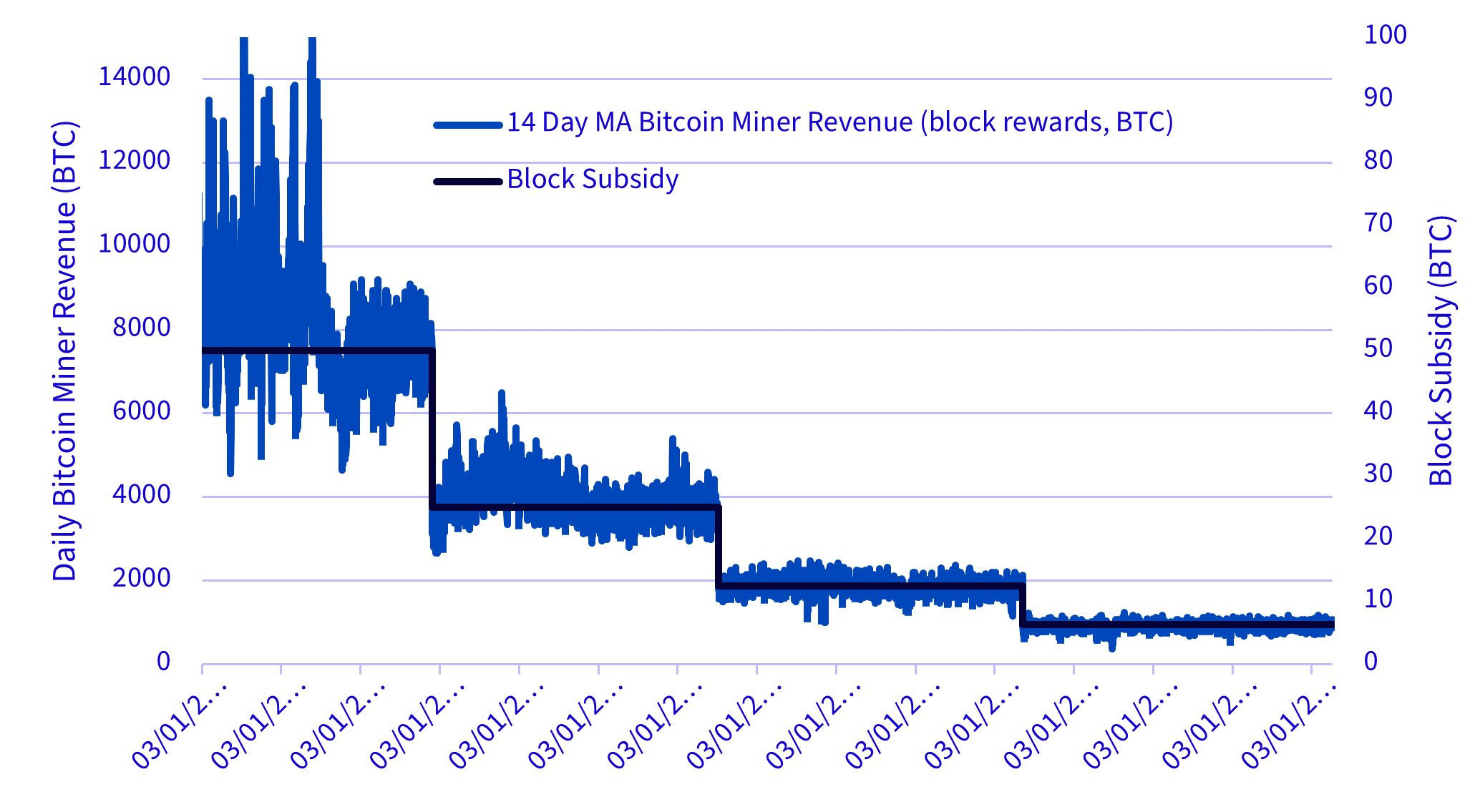

Approximately every 10 minutes, a new block is added to the blockchain, recording transactions from individuals on the bitcoin network from all across the globe. To add these blocks to the blockchain, someone, or some computer, needs to do this. This is the responsibility of bitcoin miners. As they compile transactions into blocks, validating their accuracy in the process, and add these blocks to the blockchain, there is an incentive for them to do so. This incentive comes in the form of the ‘block reward’ – part newly ‘minted’ bitcoin called the block subsidy, and part transaction fee paid by those transacting. Combined, these serve as payment for their efforts. Every 210,000 blocks, which equates to roughly every four years, the block subsidy is cut in half. As a result, miners get paid less bitcoin to do the same activities, and the newly minted bitcoin coming into circulation is reduced. Daily revenues paid to miners and the prevailing block reward can be seen in Figure 1 below, with the halving events reflected by the downward ‘steps’ in the block subsidy.

Figure 1: Block rewards and bitcoin miner revenue (BTC)

Sources: Glassnode, WisdomTree as of April 2024.

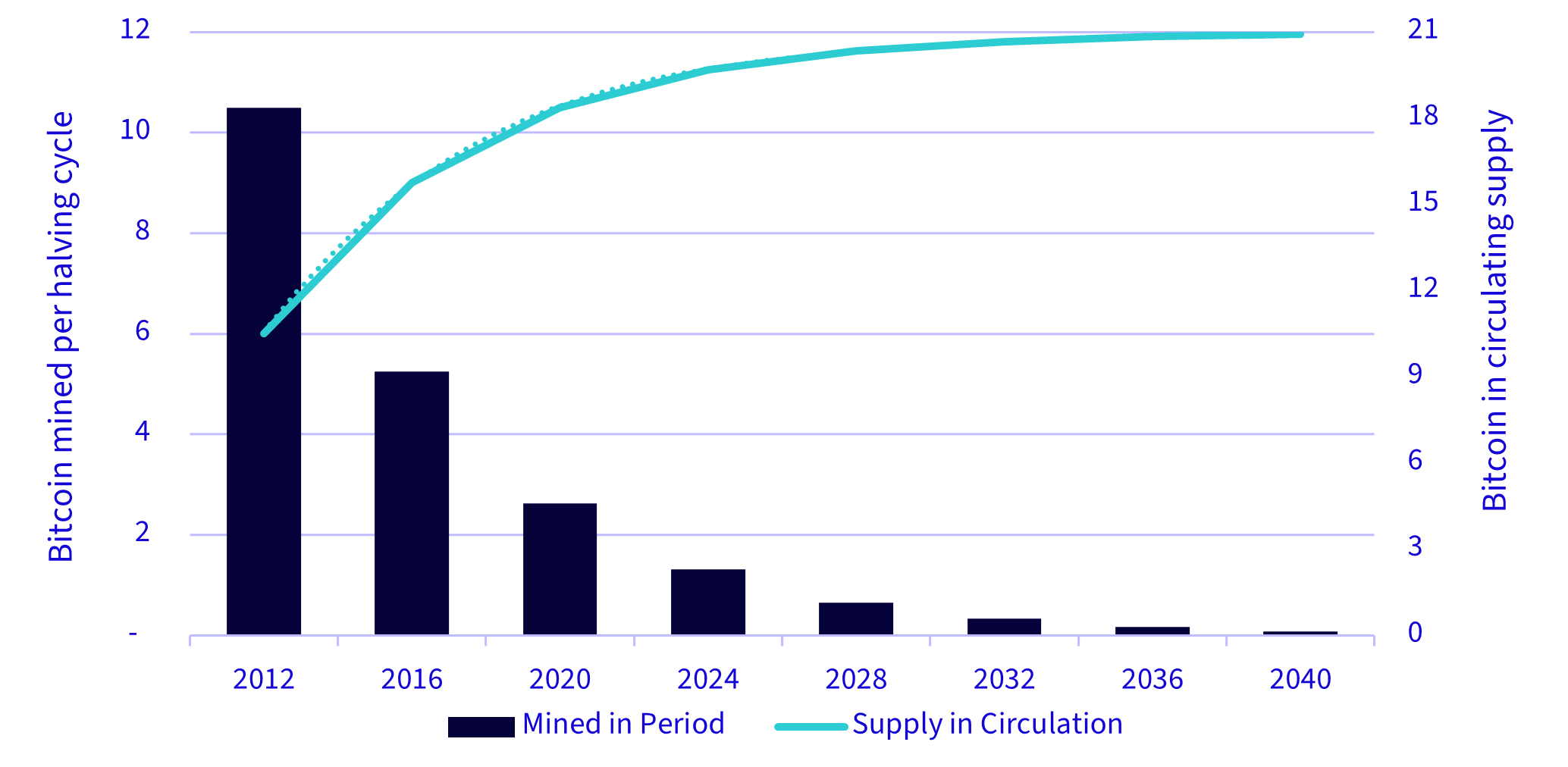

Subsequently, each halving ‘cycle’ has a fixed amount of bitcoin issuance as a function of the block subsidy (210,000 blocks x block subsidy = newly minted bitcoins paid to miners). Halving events repeat until the block subsidy becomes negligible, at which point no new supply comes online and the prevailing supply is all that will ever be – 21m bitcoin. This can be verified in the code in two separate places, in the function defining block subsidy as well as in another function explicitly setting the max. These supply dynamics can be see in Figure 2.

Figure 2: Bitcoin mined per halving cycle and circulating supply, millions

Sources: Capital.com, Zenledger.io, WisdomTree 2024.

The broad implications for investors

The broad implications of the halving are threefold:

- Reduced bitcoin denominated payment for miners (reduced block subsidy)

- Reduced supply coming online, with a max supply of 21m

- Bitcoin has an alternative, transparent monetary policy providing an alternative investment exposure

The first implication is that holding all else constant, including bitcoin price in US dollar terms, it can lead to pressure on miners as their input costs come in the form of energy to run the computers adding these blocks to the blockchain. If the USD price doesn’t remain above input costs, poorly capitalised bitcoin mining companies may be forced to consolidate, restructure, or shut down. Investors with bitcoin mining equity exposure may want to be mindful of this dynamic as we see the price of bitcoin evolve over the coming weeks.

The second implication is to reiterate the overall reduction in bitcoin supply coming into circulation. With only so many blocks processed per day, for each of these blocks, the miner is being rewarded with less newly minted bitcoin. In a couple of days, the block subsidy will be reduced from 6.25 to 3.125 bitcoin and mark a point in time where 19.7m bitcoin (or nearly 94% of supply) are in circulation. Since these subsidies are ‘halved’ regularly, the overall newly minted bitcoin reduces until we eventually reach 0, and a maximum circulating supply of 21m bitcoin is reached.

The third serves as a reminder of the transparent and immutable monetary policy implemented through the Bitcoin software. There is no question about if and when these reductions in issuance take place, nor is there a group of leaders such as central bank policymakers, ‘reacting to the data’ to determine the best policy actions going forward. In a fiat world where target inflation set to 2% is constantly deteriorating buying power, bitcoin can serve as a reasonable alternative to this fiat system, providing a long-term store of value alongside other assets like gold.

Is it too late?

Given recent performance, investors reading this may wonder if it is too late. Only time will tell. Many institutions are only just beginning to allocate or evaluate such investments, meaning bitcoin’s total market capitalisation has reached a point of 1.3 trillion USD nearly all on retail investment. With a significant portion of global capital not yet deployed in this space, it is still early days. We saw this with the introduction of the spot bitcoin exchange-traded funds (ETFs) in the US. In the weeks following, approximately 10 billion USD flowed into such funds, accumulating over 200,000 bitcoins by mid-March. In a matter of weeks, ETF demand surpassed nearly a fourth of all bitcoin that will be mined over the next four years, and surpassed all of the bitcoin that will be mined after the year 2032.

Bitcoin halving cycle details

| Event | Date | Block | Block subsidy | Supply mined | Supply in circulation | % Supply in circulation |

|---|---|---|---|---|---|---|

| Launch | January 2009 | 0 | 50.00 | 10,500,000 | 10,500,000 | 50.0% |

| Halving 1 | November 2012 | 210,000 | 25.00 | 5,250,000 | 15,750,000 | 75.0% |

| Halving 2 | July 2016 | 420,000 | 12.50 | 2,625,000 | 18,375,000 | 87.5% |

| Halving 3 | May 2020 | 630,000 | 6.25 | 1,312,500 | 19,687,500 | 93.8% |

| Halving 4 | April 2024 | 840,000 | 3.13 | 656,250 | 20,343,750 | 96.9% |

| Halving 5 | Estimated 2028 | 1,050,000 | 1.56 | 328,125 | 20,671,875 | 98.4% |

| Halving 6 | Estimated 2032 | 1,260,000 | 0.78 | 164,063 | 20,835,938 | 99.2% |

| Halving 7 | Estimated 2036 | 1,460,000 | 0.39 | 82,031 | 20,917,969 | 99.6% |

| Halving 8 | Estimated 2040 | 1,680,000 | 0.20 | 41,016 | 20,958,984 | 99.8% |

Sources: Capital.com, Zenledger.io, WisdomTree 2024. Supply Mined, Supply in Circulation , % Supply in Circulation are as of end of period (halving cycle).

Furthermore, halving events have historically been a great time to begin allocating. In previous cycles, significant positive price action has followed halvings, with each returning multiple times the initial investment within approximately one year from the onset. We know the future is uncertain, and we can’t look at history to predict what will happen next, but it is worth noting a pattern has emerged in alignment with the basic supply and demand narratives from above.

| Event | Date | 1M Return | 6M Return | 1Y Return |

|---|---|---|---|---|

| First Halving | November 2012 | 9.1% | 923.7% | 8136.9% |

| Second Halving | July 2016 | -10.9% | 37.2% | 281.2% |

| Third Halving | May 2020 | 8.4% | 82.5% | 559.5% |

Source: Glassnode, WisdomTree 2024.

Bitcoin is highly speculative and involves a high degree of risk, including the potential for loss of the entire investment. An investment in bitcoin involves significant risks (including the potential for quick, large losses) and may not be suitable for all investors.

It will be interesting to see how things play out in the coming weeks. This halving is the first that has seen such widespread media coverage; notably traditional financial news outlets like Bloomberg and CNBC have reported on it, as well as the increased access through widely available exchange-traded product (ETP) and ETF offerings improving ease of access, and institutions coming on board.