In the early weeks of 2024, the US Securities and Exchange Commission (SEC) approved 11 filings for spot Bitcoin exchange-traded funds (ETFs), a watershed moment following years of meticulous scrutiny1. This breakthrough followed a judicial rebuke of the SEC’s prior dismissals, which were deemed by the judge as ‘arbitrary and capricious,’ considering the prior approval of futures-based ETF products linked to Bitcoin futures on the Chicago Mercantile Exchange2.

For US crypto investors, the pre-approval landscape was fraught with less-than-ideal choices: managing crypto wallets directly, entrusting assets to unregulated exchanges, investing in futures-based strategies that underperform due to roll costs, or illiquid fund structures prone to significant price deviations from Net Asset Value (NAV)3. This dilemma stalled investor allocation decisions, fostering a ‘wait and see’ perspective—not just domestically, but globally, as investors navigated unclear international regulation, frequently cueing from the U.S. regulator.

The SEC’s approval has opened the gates for a broader US investor base to seamlessly invest in bitcoin, circumventing the cumbersome onboarding processes, sidestepping new counterparty risks, and forgoing the additional compliance paperwork. The ETF vehicle, familiar to many investors, offers a straightforward ‘plug and play’ method for entering this burgeoning asset class.

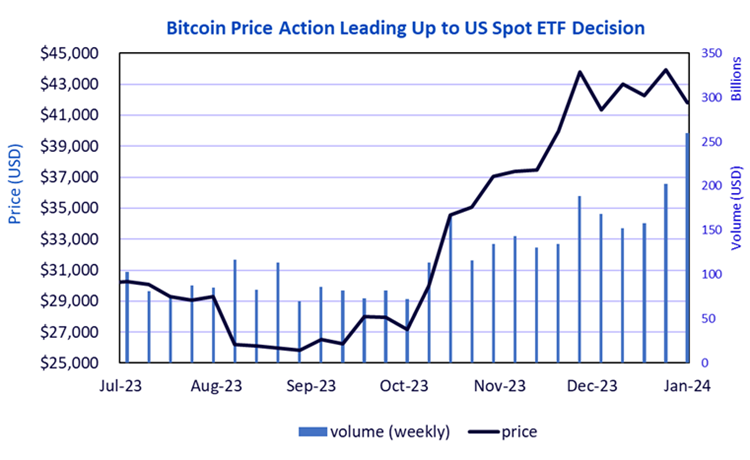

We’ve explained the market implications and the potential ripple effects, globally, of this major milestone for digital assets. The tantalising prospect for the $30+ trillion parked in US retirement accounts4 could herald substantial capital inflows in the forthcoming years. Although the initial aftermath of the ETF launches have been subdued, with bitcoin experiencing a ‘buy the rumor, sell the news’ market reaction, our long-term outlook remains optimistic. In many cases, US platforms that would never consider approving direct digital asset investments can now consider beginning their due diligence on an exchange-traded product (ETP), a familiar structure that can fit into their current systems more simply.

Source: Coinmarketcap, as of 8, January 2024

Historical performance is not an indication of future performance and any investments may go down in value.

Current Landscape of Crypto Investment

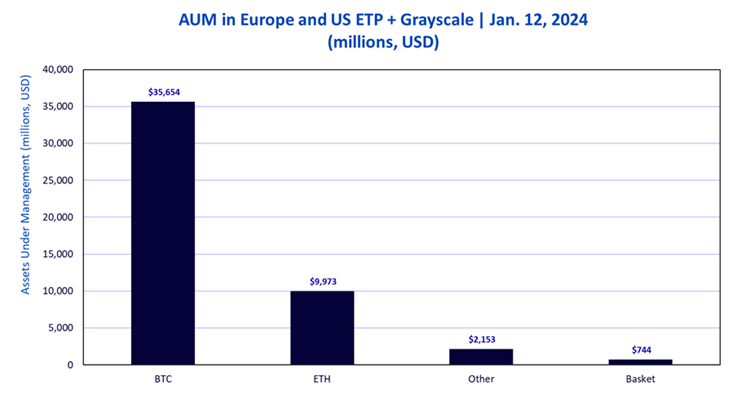

The allure of ETPs and ETFs as viable investment vehicles for cryptocurrencies is not just conjecture; it’s substantiated by their total global assets under management (AUM). As of January 2024, Bitcoin ETPs boast over $35 billion in AUM, with nearly $2 billion in net inflows for the year5. This is on a base of overall bitcoin market capitalisation of approximately $800 billion, at current prices. Ether, the next largest digital asset by market capitalization sat at approximately $300 billion, for reference.

Source: Bloomberg, 12 January 2024. Includes AUM for over 150 crypto ETPs across Europe and North America. Includes Grayscale funds.

Historical performance is not an indication of future performance and any investments may go down in value.

In the US, while the AUM figures post-ETF launch remain modest, a discernible pattern has emerged: established asset managers with diversified businesses are attracting the lion’s share of AUM. This trend underscores a fundamental investor behavior, reliance on familiar and trusted institutions. With the diversified providers at the forefront, capturing significant bitcoin inflows, adding to their expansive global AUM across diversified asset classes. This shift in investor preference is at the expense of specialised managers who solely concentrate on niche markets such as digital assets or technology.

As the integration of digital assets into multi-asset portfolios gains traction, we anticipate this trend to persist globally. Investors have been effectively ‘voting with their assets,’ opting for the most robust solutions at the fairest prices and favoring asset managers with a diversified business model and a proven track record in protecting and managing their hard-earned cash. After all, digital asset investors have witnessed the downfall of many promising but risky upstarts, such as the FTX exchange6, and they are aware of the need for caution and diligence, particularly when it comes to choosing partners in accessing the digital assets investment realm. Trusted providers with a long-standing experience in offering institutional-grade solutions appear to be the direction of travel.

Since as early as 2019, European investors have had access to crypto ETPs. With access to single coins, as well as diversified basket products, the European ETP market has evolved more quickly than the US. As European investors evaluate an array of options in terms exposures and issuers, will they follow the trend in the US by sticking with the partners they know and trust, or expand their reach to new entrants?

Sources

1 Bloomberg, January 2024, https://www.bloomberg.com/news/articles/2024-01-10/spot-bitcoin-etfs-approved-to-launch-in-us-by-gensler-s-sec

2 Bloomberg, October 2023, https://news.bloomberglaw.com/us-law-week/what-grayscales-victory-in-bitcoin-case-means-for-crypto-market

3 Ycharts, January 2024, https://ycharts.com/companies/GBTC/discount_or_premium_to_nav

4 Investment Company Institute, December 2023, https://www.ici.org/statistical-report/ret_23_q3

5 Bloomberg, WisdomTree, January 2024.

6 Bloomberg, October 2022, https://www.bloomberg.com/news/articles/2022-11-11/ftx-com-goes-bankrupt-in-stunning-reversal-for-crypto-exchange