Key Takeaways

- Inflation has shown notable improvement from its 2022 peak readings, but the road ahead may not be easy.

- Both Core CPI and Core PCE inflation readings reversed course in 2023, but the pace of improvement has slowed down in the last two to three months.

- There could be some daylight emerging between Fed policy makers regarding the timing and extent of rate cuts, with Fed Chairman Powell less deterred by recent inflation readings and Governor Waller suggesting a reduction in the overall number of rate cuts or pushing them further into the future.

Even though I have never come anywhere close to running a marathon of any sort, I am told the last mile could be the most difficult part of the endeavor. Looking at how inflation has performed to begin 2024, it appears the improvement investors have witnessed over the first 25 miles of this marathon could have been the easy part, and the road to mile number 26 may be harder.

The money and bond markets may have gotten a little complacent on inflation trends after the 2023 experience. Indeed, the peak readings of 2022 for both headline and core inflation were put in the rearview mirror rather quickly, as price pressures cooled off on an almost monthly basis. Given the rally in the Treasury market that was witnessed in Q4 of last year, there is little doubt that this type of improvement was expected to continue, perhaps leading to the Federal Reserve achieving their 2% threshold in the process.

Core Inflation

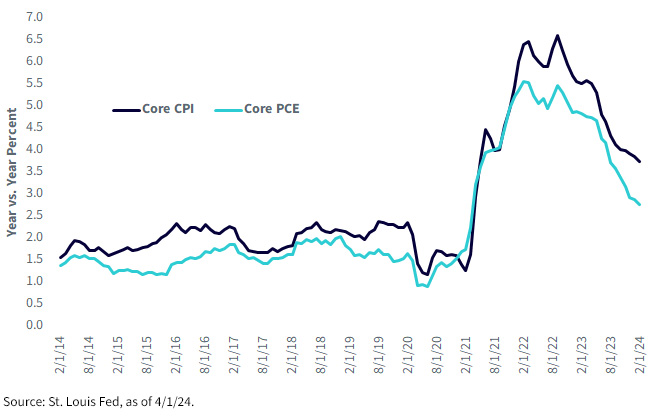

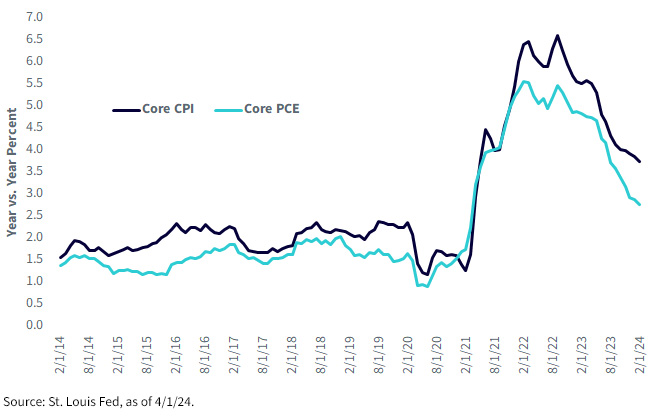

For this blog post, I am going to focus solely on inflation minus food and energy, using two different gauges: the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE). Interestingly, one could argue the markets focus more on the CPI gauge, while the Fed uses the PCE measure for its official inflation target.

As you can see, both core inflation readings reversed course in 2023, but the degree of improvement has leveled off somewhat. Core CPI and PCE each hit their peak year-over-year gains of 6.6% and 5.5%, respectively, in September 2022 and dropped to roughly 4% and 3% toward the end of last year. However, the pace of improvement has become a bit more grudging over the last two to three months, with Core CPI coming in at 3.8% and Core PCE at 2.8% in February, the latest data available.

Given this backdrop, what’s a central banker to do? Looking at recent comments from Fed Chairman Powell and Governor Waller, one gets the consistent message that the voting members are not in a hurry to cut rates, but that rate cuts will more than likely occur this year. However, there seems to be some daylight between these two policy makers’ views on when and by how much. While Powell doesn’t seem to be overly deterred by the recent inflation readings, Waller did say the data is leading him to believe that “it is appropriate to reduce the overall number of rate cuts or push them further into the future.”

Powell has also recently mentioned that perhaps inflation doesn’t need to get down precisely to the Fed’s 2% target. Does that mean that Core PCE at 2.5% would be viewed as an acceptable point to begin cutting rates? If you look at the history of Core CPI and Core PCE, there is usually a spread between their year-over-year readings, with the post-COVID period of December 2020–December 2021 being the only exception over the last 10 years. If this spread holds, would the Fed feel comfortable lowering rates if Core CPI was somewhere between 3% and 3.5%?

Conclusion

While the Fed may look to begin easing in such a scenario, the U.S. Treasury 10-year note may not be that thrilled, especially if the labor market data remains resilient and solid.